Remember, Keep Safe Care Direct’s mission is to make things easier, save you money, and lower stress!!! And these tax issues are no different. We have laid out everything for you, including capturing your deductions for Local, State, and Federal Taxes. As a courtesy, we will generate a W-2 for each Caregiver (employee) you have hired, and with this information you can then generate your W-3 and Schedule H forms. Keep Safe Care Direct has even partnered with The Nanny Tax Company to help with tax and filing issues at a member’s rate. Remember, we want to empower you with information and tools to help you find the ideal well-matched, dependable, reliable Caregiver, and at the same time save you between $200 to $575 per week in costs!! We know for some people, this can be scary because it is an unknown, and we want to dispel those fears and make sure that you are being a great citizen by abiding by the law. While some of you may be able to file your own quarterly and yearly tax obligations, Keep Safe Care Direct has partnered with The Nanny Tax Company to help those who need it. You may contact Laura Weiland, CEO at:

Laura Weiland, CEO

The Nanny Tax Company

laura@nannytaxprep.com

(nannytaxprep.com)

(800) 747-9826

We have also generated a list of Tax and Employment Questions and Answers below for your edification and information. Just click on the link to open the Q&A item. As always, if you have any questions, you can Help from Keep Safe Care Direct at help@keepsafecaredirect.com.

(click on questions to view answers)

What are nanny taxes?

When you hire someone to work in your home, like a Caregiver, the government considers you an employer. As the Employer of Record you are responsible for paying employment taxes. These employment taxes are commonly known as “nanny taxes” although they do not only apply to nannies. They are for anyone working in your home, also known as a domestic worker. There are two components of nanny taxes: what the employer has to contribute and the employee withholding.The employer contribution includes Social Security, Medicare, federal unemployment and state unemployment taxes. The federal government requires all domestic employers to have an EIN (Employer Identification Number). The employee withholding includes Social Security and Medicare and possibly federal, state and city income taxes. Keep Safe Care Direct sets aside all of the withholdings that are necessary to be in compliance with Federal and State tax requirements to make it easy for you to print and prepare your own taxes, share the documents with your CPA or you can hire The Nanny Tax Company.

Why should I pay nanny taxes?

When you hire someone to work in your home, like a Caregiver, the government considers you an employer. As the Employer of Record you are responsible for paying employment taxes.These employment taxes are commonly known as “nanny taxes” although they do not only apply to nannies. They are for anyone working in your home, also known as a domestic worker. There are two components of nanny taxes: what the employer has to contribute and the employee withholding.Yes, it is true, you might feel like NOT paying these taxes and might be thinking, “Why should I pay nanny taxes? No one else pays them and I’m not running for public office.” And you would be right, still there are three really good reasons why you should pay nanny taxes:

- It’s the right thing to do – not only are you protected if audited, but your employee benefits from having Social Security and Medicare taxes paid, as well being eligible for unemployment compensation if the Caregiver no longer works for you. Recording what a Caregiver makes insures they will have a record of what they have earned for the year which they will need when making a large purchase like a house or car or applying for college aid.

- You can SAVE money by paying nanny taxes. There are two strategies to reduce your nanny taxes: Flexible Spending Accounts and the Child and Dependent Care tax credit. See How can I save money by paying nanny taxes? (below) for more information.

- The IRS will catch you. If you do not report your household employee’s wages and pay the associated taxes and you are audited, you will be subject to penalties and interest. See Can the IRS catch me if I have not paid nanny taxes? (below) for more information.

Am I required to pay nanny taxes?

If you pay an employee working in your home $1,900 or more a year, you must pay Social Security and Medicare taxes.If you pay an employee working in your home $1,000 or more per calendar quarter, you must pay federal and state unemployment taxes (some state have a lower threshold for unemployment liability). See When and how often do I pay my nanny taxes? (below) for more information.

How do I get my Employer Identification Number (EIN)?

Actually, the Internal Revenue Service makes getting an EIN pretty straight forward with a very easy to use online process. First, click on the link below:

https://sa.www4.irs.gov/modiein/individual/index.jsp

Next, click the Begin Application >> button on the page (see below)

On the next page, select Sole Proprietor

On the next page, select Sole Proprietor

On the next page, select Household Employer, then click Continue >>

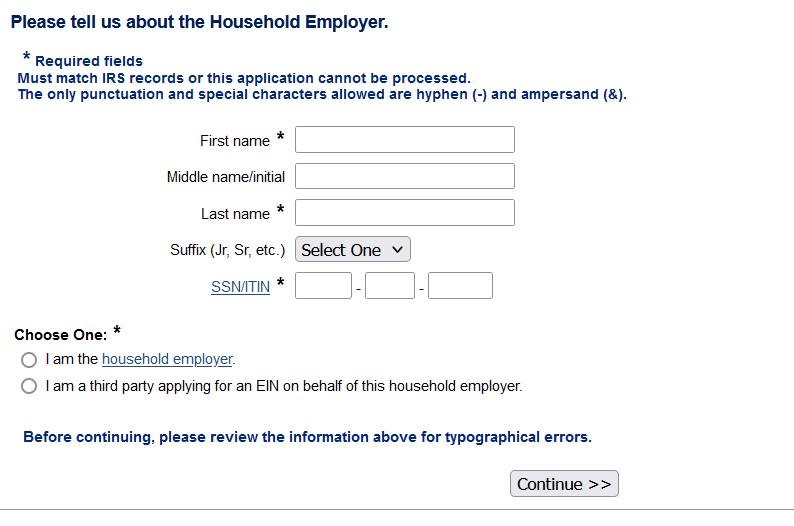

Proceed to this page, fill it out and indicate that you are a household employer.

You will then be assigned an EIN. Please print or save that resultant page.

When and how often do I pay my nanny taxes?

- Federal nanny taxes (Social Security, Medicare, income taxes, and federal unemployment) are generally paid with your federal income taxes.

- State nanny taxes (unemployment and income taxes) are generally paid quarterly although some states have monthly or annual filing requirements.

- In addition, you must give your employee a W-2 by January 31 and file the W-2 and W-3 forms with the Social Security Administration by January 31, and Keep Safe Care Direct will produce these forms for you.

What are the nanny tax deadlines?

You must file your nanny taxes by the due date. If you file after that date, you may have to pay penalties and interest.

Jan 31

- 4th Quarter State Unemployment Taxes

- 4th Quarter State Income Tax Withholding#

- W-2 to Employee

- W-2 and W-3 to Social Security Administration

Feb 28

- State Income Tax Reconciliation#

Apr 15

- Schedule H filed with Federal 1040 Return to reconcile federal nanny taxes

Apr 30

- 1st Quarter State Unemployment Taxes

- 1st Quarter State Income Tax Withholding#

Jul 31

- 2nd Quarter State Unemployment Taxes

- 2nd Quarter State Income Tax Withholding#

Oct 31

- 3rd Quarter State Unemployment Taxes

- 3rd Quarter State Income Tax Withholding#

* These dates apply to most household employers.

# These filings are not necessary if no income tax is being withheld

Am I required to withhold federal and state income taxes?

You are not required to withhold these taxes unless your employee asks you to and you agree. If you do not withhold income taxes, your employee (Caregiver) must pay these taxes to the government themselves so it is very important to discuss this with your employee during your salary negotiations.

What are unemployment taxes?

Federal and State Unemployment taxes fund Unemployment Benefits paid to workers who have lost their jobs. Each state has a different method for determining your Unemployment Taxes and tax rate. If you pay State Unemployment Taxes, this is considered a legal deduction and you can get a credit toward Federal Unemployment Taxes.

I am a Caregiver, when do I pay my taxes?

Your employer is required to give you a form W-2 by January 31st. This form will show your wages and any taxes withheld. You will use this form to file your income tax return.Since your employer (Careseeker} is not taking out any income taxes, you may be required to make quarterly estimated income tax payments. For more information about when, how, and where to submit these taxes, click here: Publication 505, Tax Withholding and Estimated Tax and look for the “Estimated Tax” link in the publication.

What does it mean to be the Employer of Record?

A company or organization or individual (Careseeker) that is legally responsible for paying employees, in this case your Caregiver. The Employer of Record, often referred to as the W-2 Employer of Record because they are responsible for issuing W-2s to the employee, shoulders the responsibility for all the traditional employment tasks and liabilities, including dealing with employee taxes. As the Employer of Record, Keep Safe Care Direct will be issuing payroll checks for you and generating your end of year W-2s and Schedule H for each and every Caregiver you have hired. You, as the Employer of Record, are responsible for submitting local, state, and federal payroll taxes.

Who takes out taxes? Does the Careseeker or Caregiver pay for taxes?

If you are the Careseeker (employer), you are required to take out the employee’s withholding including Social Security and Medicare and possibly federal, state and city income taxes. In addition, the Careseeker (employer) has a contribution to in Social Security, Medicare, federal unemployment and state unemployment taxes. All totaled, this equates to an additional 10% ($1.20) to 15% ($1.75) to the wages you pay an employee per hour. Remember, even with these taxes and hiring your own Caregiver, you are saving on average between $6/hr to $15/hr over hiring a private duty agency, or between $10,000 to $30,000 per year.

How do I get help with my taxes?

Of course if you already have an accountant or access to a CPA, they are your best avenues for advice. If not, we have partnered with The Nanny Tax Company (www.nannytaxprep.com); (800) 747-9826 and Keep Safe Care Direct Members can contact them for some information and advice concerning Nanny Taxes. That is ALL that they do! In addition, KSCD members get access to special, discounted pricing for filing of their quarterly State taxes. KSCD will generate a W-2 and your Schedule H for every Caregiver you have hired and paid thru our system.

What if I do not take out my taxes? Will I get caught?

Or stated another way, Can the IRS catch me if I have not paid nanny taxes?

YES. There are several ways you can be “caught” by the IRS.

- If your employee files for unemployment benefits after their employment with you ends and you have not paid your State Unemployment Taxes, the State Unemployment Office will fine and penalize you, and report you to the IRS.

- f your employee becomes disabled, cannot work and files for social security disability benefits and you have not paid your employee’s Social Security and Medicare taxes, the Social Security Administration will impose back taxes, interest and penalties.

- If your employee files a tax return and includes the wages from your employment and you have not provided a W-2 to the employee, the IRS will fine and penalize you for the back taxes.

- If both parents work and your tax return does not include available tax credits, the IRS may become suspicious and audit your tax return.

- If your employee retires and applies for Social Security and Medicare benefits. If you have not paid your employee’s Social Security and Medicare taxes, the Social Security Administration will impose back taxes, interest and penalties.

There is no statute of limitations for failing to report and pay federal payroll taxes.

How do I file my taxes?

You have three choices: 1) You can file your quarterly State taxes on line with most States, and your yearly Federal Taxes when you file your own tax return; 2) You can have your accountant or hire a CPA to file these returns for you; or 3) You can use one of our partners, such as The Nanny Tax Company, who specialize in filing nanny taxes at a discounted rate. The choice is yours.

How can I save money by paying nanny taxes?

There are two strategies you may be able to use to minimize your nanny taxes. You can use a Flexible Spending Account offered by your employer or the Child and Dependent Care tax credit to reduce your nanny tax costs. These credits are only available to you if you pay your nanny taxes.

The Flexible Spending Account (FSA). You may be able to withhold pre-tax money from your paycheck in order to reimburse yourself for child and dependent care costs. With this option, you may reduce or completely offset your nanny tax costs! Check with your employer to see if they offer this benefit.OR

The Child and Dependent Care tax credit. This is a credit that can reduce your Federal Income Taxes but there are several tests you must pass in order to qualify for this credit.